We've been getting a number of calls from AgStar users who've been advised by their attorneys, insurance agents, or other business contacts that their payroll paycheck stubs need to show sick leave accrued and/or used, in addition to the current balance. So we checked. And as far as we can tell, that's just not true.

We went to the State of California Department of Industrial Relations website, and verified their posted requirements. According to that website, California only requires the pay stub to show the sick leave available.

This is explicitly stated on their website, in the "California Paid Sick Leave: Frequently Asked Questions" page:

How will I know how much sick leave I have accrued? Employers must show how many days of sick leave you have available on your pay stub, or on a document issued the same day as your paycheck.

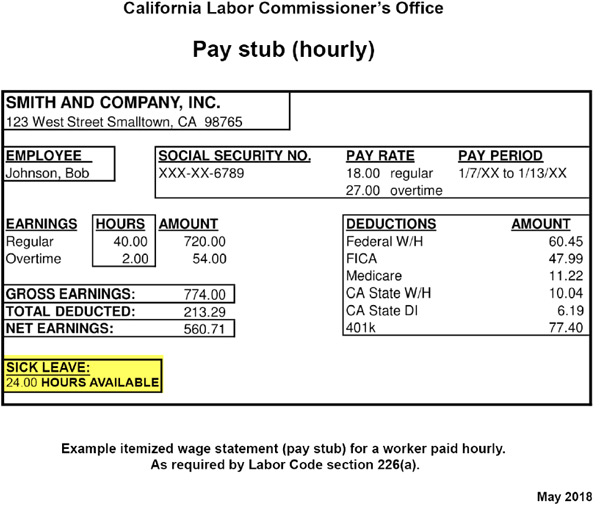

The Department of Industrial Relations also provides a sample pay stub for hourly workers, available here. That model also shows only the sick leave hours available: However, if you want to voluntarily provide more information, AgStar offers an alternative check stub format that includes the details of sick leave accrued, used, and balance remaining (see sample below). With this format, both stubs are used as one continuous page, which allows much more detail in a more readable format. However, because this uses both stubs as a continuous page, you can’t have anything pre-printed on the bottom stub (e.g., the company name).

However, if you want to voluntarily provide more information, AgStar offers an alternative check stub format that includes the details of sick leave accrued, used, and balance remaining (see sample below). With this format, both stubs are used as one continuous page, which allows much more detail in a more readable format. However, because this uses both stubs as a continuous page, you can’t have anything pre-printed on the bottom stub (e.g., the company name).

To switch to the Detail check format:

To switch to the Detail check format:

- From the Payroll module, go to File, Payroll setup.

- Click on Check format

- In the Format section, select “Payroll check with detailed stub – agpylc01.qrp”

- Or, if your checks are QuickBooks format, select “QB Two Bottom Stub Detailed - CUPYCKQ9.qrp” instead.